MyHealth360

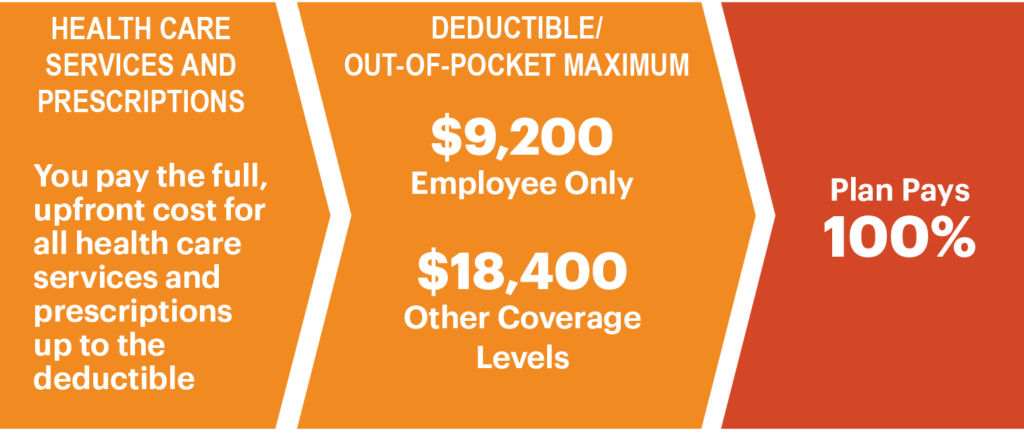

MyHealth360 provides a medical plan with access to prescription drug coverage. If eligible, you can select one of four coverage levels: Employee Only, Employee + Child(ren), Employee + Spouse/Domestic Partner or Family.

What to know

- Piedmont PRN Plan: If you are interested in enrolling or making changes to current elections, please complete the online enrollment form and return via email to PRNMedicalBenefits@piedmont.org

- The Piedmont PRN Plan provides medical and prescription drug coverage

- Prescription drugs are administered directly by Express Scripts

- Access to fertility, pregnancy and postpartum benefits and support for menopause and midlife care through Progyny (beginning Jan. 1, 2025)

- Medicare navigation support through SmartConnect at no cost to you

- Provider networks based on in- or out-of-network structure

- Participate in well-being activities to earn points to apply towards sweepstakes